Did you know that the role of a Chief Financial Officer (CFO) is often considered the toughest job in the C-suite? It’s not just about crunching numbers—it’s about managing financial strategy, mitigating risks, and keeping the business on a sustainable growth path. Now, imagine how tricky it gets when the pool of experienced CFO candidates is shrinking every year. Fewer candidates mean higher salaries, making this vital role one of the most expensive to fill.

So, what’s a business to do? More and more companies are finding their answer in outsourcing. Instead of hiring a full-time CFO, they’re opting for outsourced CFO services, giving them access to top-tier financial expertise without the hefty price tag. It’s a win-win: you get the insights and strategy your business needs to scale, without the long-term commitment or sky-high costs.

In this article, we’ll dive into why an outsourced CFO might just be the secret weapon you need to take your business to the next level. From streamlining accounting and financial management to crafting strategies that help you grow, this approach could be exactly what your business needs. Let’s explore how!

What Is an Outsourced CFO?

An outsourced CFO is a chief financial officer who works with your company on a part-time, project-based, or flexible schedule, offering strategic financial insights without being a permanent, in-house employee. Essentially, you get all the benefits of an experienced CFO—without the expense of hiring one full-time.

What Does an Outsourced CFO Do?

From startups to established businesses, an outsourced CFO serves as a versatile resource for financial planning, risk management, and strategy development. Their tasks might include:

Budgeting and forecasting to help you plan for the future.

Managing cash flow to ensure your business has the resources it needs to operate smoothly.

Overseeing accounting and bookkeeping to keep your financial records accurate.

Preparing your company for investment rounds or acquisitions.

Using tools like cloud accounting and automation to streamline operations.

In short, an outsourced CFO isn’t just about keeping your books balanced—they’re about helping your business thrive.

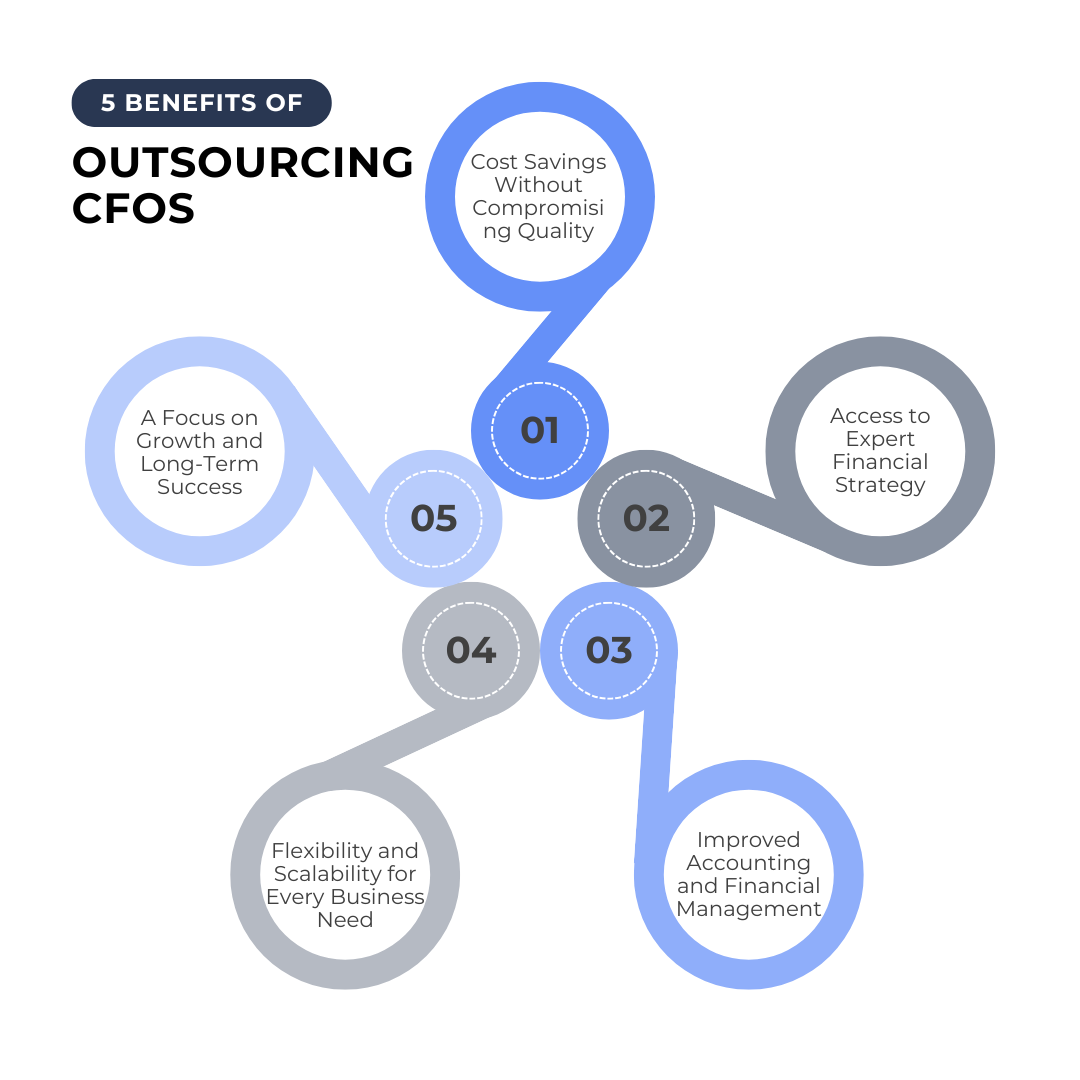

5 Benefits Of Outsourcing CFOs

1. You Save Money Without Compromising Quality

Hiring a full-time CFO can cost well into six figures annually, not including benefits, office space, and other overhead expenses. By outsourcing, you only pay for the services you need, whether that’s on a fractional basis or for specific projects.

With an outsourced CFO, you get access to top-tier financial expertise at a fraction of the cost. You can scale services up or down based on your business needs, ensuring you’re always getting value without overspending. This makes outsourcing an ideal solution for startups and growing companies looking to optimize resources.

2. You Gain Expert Financial Strategy

An outsourced CFO is a financial powerhouse with years of experience helping businesses create and execute winning strategies. Whether you need help with financial analysis, planning and analysis, or developing a solid budget, their insights can guide your business toward sustainable growth.

These finance professionals bring expertise in diverse areas, such as managing mergers, securing funding, or improving profitability. They can also identify growth opportunities and provide actionable strategies to capitalize on them, helping you stay competitive in an ever-changing market.

3. You Improve Your Accounting and Financial Management

Keeping your accounting and finance function in order is essential for any successful business. An outsourced CFO works with your controller, accountant, and bookkeeper to streamline processes like bookkeeping services, financial reporting, and compliance.

Many outsourced CFOs also use tools like cloud accounting and automation to increase accuracy and efficiency. These technologies help ensure your financial data is up-to-date and accessible, making it easier to make informed decisions and stay on top of your cash flow.

4. You Get Flexibility for Every Business Need

One of the standout benefits of outsourced CFO services is their flexibility. Whether you’re a startup preparing for rapid expansion or an established company looking for short-term support, outsourcing provides customized services to your business needs.

By engaging an outsourced CFO, you can scale their involvement based on your workload or financial priorities. From acting as a fractional CFO during key projects to offering ongoing guidance, outsourcing ensures you get the right level of support at the right time.

5. You Can Focus on Growing Your Business

At the heart of outsourced CFO services to help businesses thrive is their ability to focus on growth. By taking over the complexities of finance and accounting, they allow you to concentrate on running your business.

From creating detailed financial strategies to implementing talent solutions for better decision-making, an outsourced CFO helps position your company for long-term success. Their expertise in areas like fundraising, risk management, and efficiency improvements ensures you’re always ready for the next big opportunity.

How Outsourced CFO Services Can Help Your Business

Strategic Financial Planning

One of the biggest advantages of outsourcing CFO services is the ability to craft a detailed financial strategy tailored to your business goals. An outsourced CFO can help you:

Create a clear budget that aligns with your company’s vision.

Analyze trends and make data-driven decisions with forecasting tools.

Identify new opportunities for growth and profitability.

This kind of strategic planning is essential for businesses that want to scale, especially in today’s competitive landscape.

Better Cash Flow Management

Every business owner knows that cash is king. Managing your cash flow effectively can mean the difference between success and failure. An outsourced CFO helps by:

Pinpointing potential cash shortages and developing solutions.

Streamlining your invoicing and payment processes.

Ensuring your business has enough liquidity to meet its obligations.

With their expertise, you can avoid common pitfalls and keep your business running smoothly.

Leveraging Technology with an Outsourced CFO

Modern outsourced CFOs are all about leveraging technology to optimize your accounting and finance function. Tools like cloud-based accounting programs and automation make it easier than ever to stay on top of your finances.

How Cloud Accounting Makes a Difference

Gone are the days of endless spreadsheets and manual data entry. With cloud accounting, your financial data is always accessible, accurate, and up-to-date. This means:

Real-time reporting for better decision-making.

Reduced errors in your bookkeeping and reconciliation processes.

Enhanced collaboration with your CFO and team.

By integrating cloud technology, an outsourced CFO can bring efficiency and transparency to your operations.

What Does It Cost to Hire an Outsourced CFO?

One of the first questions business owners ask is, “How much does it cost?” The answer depends on factors like your company’s size, the complexity of your needs, and the level of engagement required.

Here’s a breakdown of typical pricing models:

Hourly rates for project-based work or consultations.

Monthly retainers for ongoing support.

Flat fees for specific deliverables, such as preparing for an investment round.

On average, outsourced CFO services cost between $3,000 and $10,000 per month. While that might seem like a lot, it’s a fraction of the cost of a full-time CFO, making it a cost-effective solution for growing businesses.

When Should You Consider Hiring an Outsourced CFO?

Outsourced CFOs can help businesses in a variety of situations, including:

Startups preparing for funding rounds or rapid growth.

Small to medium-sized companies needing better financial management.

Organizations navigating complex transitions, such as mergers or acquisitions.

Any business looking to optimize their accounting and improve financial visibility.

If your financial processes feel overwhelming or you’re struggling to hit your financial goals, an outsourced CFO can offer the guidance you need.

How to Find the Right Outsourced CFO

Start with Your Business Needs

What are you hoping to achieve? Are you looking for help with cash flow management, financial planning, or something more specific? Clearly defining your goals will make it easier to find the right match.

Look for Experience and Technology Skills

The best outsourced CFOs bring a combination of industry experience and tech-savvy solutions, like expertise in cloud accounting software and automation tools.

Ask the Right Questions

Before you commit, make sure to ask:

What industries have you worked in?

Can you integrate with our existing accounting software?

How will you track progress and measure success?

Ready to Meet Your Outsourced CFO?

If you’re ready to scale your business but don’t have the resources for a full-time CFO, outsourcing could be the perfect solution. At Proseso Consulting, we specialize in providing tailored outsourced CFO services to businesses like yours.

Whether it’s improving bookkeeping, managing your finance function, or developing a robust financial strategy, our experienced team brings the expertise and tools needed to help you grow. Using modern technology like cloud accounting and automation, we streamline your financial processes, giving you the insights and flexibility to focus on your core operations.

With Proseso Consulting, you gain access to high-level financial professionals who understand the unique challenges businesses face today. We’re committed to helping you achieve your financial goals while staying cost-effective and scalable.

Learn more about our CFO services in the Philippines or in Singapore and how we can help your business thrive. Contact us today to discuss tailored solutions for your unique needs!

This blog article does not constitute professional or legal advice. It is only intended to provide general information on a subject.