Create a financial plan that aligns with your business model and goals.

Build accurate financial projections that attract investors.

Manage your cash flow to avoid pitfalls that many startups face.

Use a template to streamline the financial planning process for your startup business.

By the time you finish this guide, you’ll understand why financial planning is important and how to prepare a financial plan for your startup that ensures long-term growth and stability. Let’s get started on building your startup’s financial model and securing your startup’s financial future.

Why Financial Planning is Crucial for Startups

Starting a startup is a thrilling venture, but without a clear financial plan, it’s like setting sail without a map. Many startup founders focus on innovation and growth, overlooking the importance of structured financial planning. However, a solid financial plan is not just important—it’s essential to the survival and success of any startup business.

Financial Planning Provides Stability in Uncertainty

The early stages of a startup are often unpredictable. Having a startup financial plan helps you navigate these uncertainties by giving you a clear picture of your current financial situation and setting a course for the future. With accurate financial data, you can identify potential challenges like cash flow gaps before they become critical problems.

By using a robust financial model, startups can plan for different financial scenarios and remain prepared, even when conditions shift unexpectedly. This proactive approach ensures your business has the stability to endure both opportunities and challenges.

Startups Need a Financial Plan to Attract Funding

For most startups, securing funding is a key milestone. Whether you’re pitching to angel investors or applying for loans, a well-structured financial plan is non-negotiable. It demonstrates that you’ve thought through your financial strategy and understand the financial aspects of your business.

Your financial plan provides investors with critical details like projected revenue, expenses, and cash flow forecasts. These financial statements build confidence, showing investors that you’re equipped to manage their capital effectively. Simply put, a strong startup financial plan can be the difference between securing funding and missing out.

Financial Planning Supports Smart Decision-Making

A good financial plan for your startup acts as a compass for decision-making. It aligns your financial objectives with your business goals, helping you allocate resources wisely. For example, when deciding whether to hire new staff or invest in marketing, your financial plan provides the insights needed to make informed choices.

This financial planning process also keeps your business agile. Regularly reviewing your financial performance ensures you can adapt to market trends, adjust budgets, and stay on track to meet your long-term financial goals.

Planning Work That Pays Off

Effective financial planning for startups is about more than just crunching numbers. It’s part of building a sustainable future for your business. When you create a financial plan, you’re not only organizing your finances—you’re giving your business the best chance to thrive. A good financial plan is a roadmap to growth, helping you manage risks, optimize operations, and achieve success in a competitive landscape.

Why Should Startups Embrace Rapid Growth

In this article, we uncover two of the main reasons why startups should embrace the path of rapid growth: Economies of Scale and Critical Mass.

Key Components of a Startup Financial Plan

A startup financial plan isn’t just about tracking numbers—it’s a strategic tool that aligns your business operations with your long-term goals. Here are the core elements that every good financial plan should include to set your startup business up for success.

1. Budgeting

At the heart of every startup financial plan is a well-thought-out budget. Your budget should provide a clear overview of expected income and expenses, ensuring you allocate resources efficiently. For early-stage startups, this means estimating costs like product development, marketing, and salaries while accounting for unexpected expenses.

To make a financial plan, start with:

Fixed costs (rent, software subscriptions).

Variable costs (marketing campaigns, supplier costs).

Emergency reserves for unforeseen challenges.

A robust budget not only keeps your business operations on track but also serves as a roadmap for growth.

2. Cash Flow Management

For startups, managing cash flow is critical. Unlike established businesses, startups typically operate with limited resources, making it vital to track every dollar coming in and going out. A good financial plan will monitor:

Cash inflows from sales, funding, or investments.

Cash outflows for operational costs and unexpected expenses.

3. Revenue Projections

Use historical data (if available) or market research to forecast revenues.

Factor in your business model and industry trends.

Create both conservative and optimistic scenarios.

Clear revenue projections demonstrate to investors that your financial plan is essential for achieving long-term growth.

4. Expense Tracking

Fixed expenses like rent or salaries.

Variable costs tied to production or scaling.

Investments in growth, such as technology or marketing.

5. Financial Statements

Income Statement: Tracks revenue and expenses to determine profitability.

Balance Sheet: Shows your assets, liabilities, and equity.

Cash Flow Statement: Highlights cash inflows and outflows.

6. Setting Financial Goals

Reducing costs by 10% over the next quarter.

Reaching a specific revenue milestone within a year.

Securing funding to expand operations.

7. Emergency Planning

8. Annual Financial Reviews

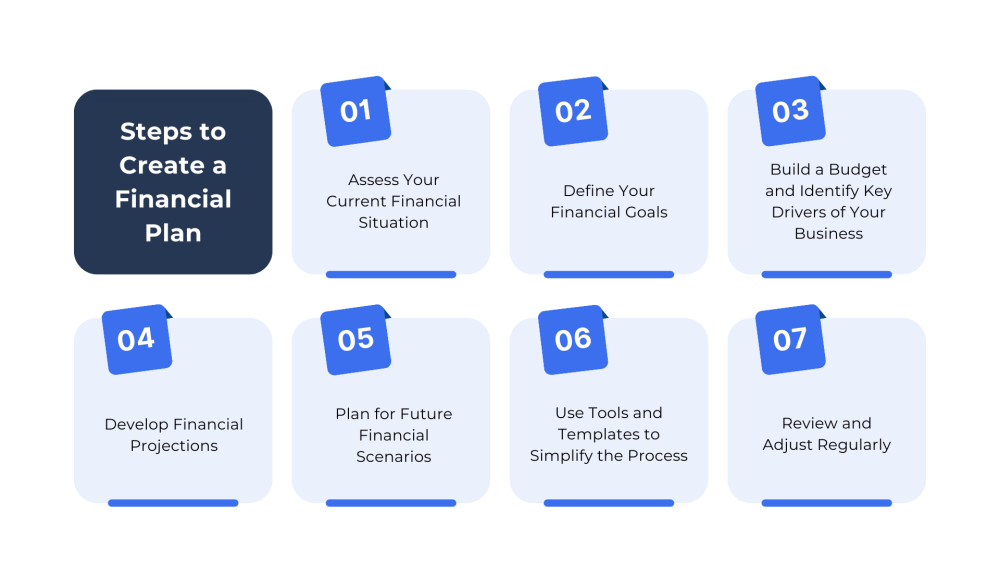

Steps to Create a Financial Plan

A well-structured startup financial plan serves as a roadmap, helping you navigate challenges, attract investors, and make informed decisions. Here’s how to build an effective financial plan for your startup, step by step.

A well-structured startup financial plan serves as a roadmap, helping you navigate challenges, attract investors, and make informed decisions. Here’s how to build an effective financial plan for your startup, step by step.

Step 1: Assess Your Current Financial Situation

Before you dive into creating projections, take stock of where your startup business currently stands financially. This includes:

Reviewing your existing financial data, like income, expenses, and cash reserves.

Identifying your immediate financial needs and any funding gaps.

This baseline assessment forms the foundation of your startup’s financial plan, ensuring your goals are realistic and aligned with your current resources.

Step 2: Define Your Financial Goals

Your financial plan should outline clear, measurable goals for both the short and long term. Think about:

Revenue milestones (e.g., reaching $500,000 in annual revenue).

Cost-cutting targets to improve efficiency.

Securing funding rounds to meet your financial needs.

Setting these financial objectives will give you a clear direction and help you track progress as you execute your financial planning process.

Step 3: Build a Budget and Identify Key Drivers of Your Business

A good financial plan is built on a detailed budget. Start by:

Categorizing your expenses into fixed (e.g., rent, salaries) and variable (e.g., marketing, production).

Allocating resources based on the drivers of your business, such as sales, customer acquisition, or R&D.

Setting realistic spending limits to avoid cash flow shortages.

This step also involves understanding your business model and ensuring that your budget supports scalable growth.

Step 4: Develop Financial Projections

Financial projections are a critical component of any startup financial plan. They demonstrate your startup’s potential and are key to attracting investors. Projections should include:

Cash flow forecasts to track inflows and outflows.

Revenue estimates based on market research and historical trends.

Expense projections to anticipate costs over time.

A 5-year financial model that outlines expected growth.

By using a template for projections, you can streamline this process and present your numbers in a professional, investor-friendly format.

Step 5: Plan for Future Financial Scenarios

No financial plan is complete without considering potential risks and opportunities. Prepare for both:

Best-case scenarios, like hitting higher-than-expected sales.

Worst-case scenarios, like unexpected expenses or market downturns.

A robust plan will help your startup business remain resilient regardless of market fluctuations, ensuring a sustainable financial future.

Step 6: Use Tools and Templates to Simplify the Process

To make your financial planning for startups more efficient, leverage modern tools:

Use financial planning software to automate tracking and forecasting.

Download a template that matches your business model to create a professional, well-organized financial plan for your startup.

These resources reduce the complexity of complex financial activities, helping you focus on strategic growth.

Step 7: Review and Adjust Regularly

Financial planning is not a one-time task. Your startup’s financial plan should be a living document that evolves as your business grows. Schedule regular reviews to:

Analyze your financial performance against goals.

Adjust your financial strategy based on market changes or new opportunities.

This step ensures your financial plan stays relevant and supports your long-term success.

Common Financial Challenges Startups Face (and How to Overcome Them)

A solid financial plan for your startup isn’t just a "nice-to-have"—it’s essential for survival. Without proper financial management, even the most promising ideas can falter. In this section of our ultimate guide, we’ll explore the most common financial challenges startups face and share strategies to overcome them.

1. Cash Flow Issues

One of the biggest reasons startups fail is poor cash flow management. Cash flow is the lifeblood of any startup business, and even a temporary gap between income and expenses can cripple operations.

Solution:

Create a financial plan that includes a detailed cash flow forecast to track money coming in and going out.

Use a template or financial planning tool to model different scenarios and prepare for potential shortfalls.

Prioritize maintaining a buffer for unexpected expenses as part of your startup financial plan.

2. Attracting Investors

Securing funding is a challenge for most startups, especially when they lack a well-prepared financial model or clear projections. Investors need confidence that your startup’s financial future is worth betting on.

Solution:

Prepare a comprehensive financial plan for your startup, complete with accurate financial statements and financial projections for at least 3–5 years.

Include in your business plan how the funds will be allocated and your projected return on investment.

A good financial plan demonstrates your understanding of key metrics like revenue, burn rate, and profitability.

3. Unplanned Expenses

Unexpected costs, from equipment failures to compliance fees, can quickly derail a startup’s financial plan if they’re not accounted for.

Solution:

Build a contingency fund into your annual financial plan.

Identify potential risks during the financial planning process and develop strategies to mitigate them.

Consider working with a financial professional to ensure all critical aspects are accounted for.

4. Scaling Too Quickly

While growth is exciting, scaling too fast without a robust financial plan can lead to overextension. Many startups raise funds only to deplete them quickly due to poor allocation or inefficient spending.

Solution:

Use your financial plan to analyze the financial implications of scaling initiatives.

Ensure your financial model is flexible enough to adapt to growth while remaining sustainable.

Regularly review your financial planning for a startup to align goals and financial resources.

5. Managing Financial Complexity

As a startup business grows, financial operations become more complex. Without clear processes, managing payroll, taxes, and operational costs can feel overwhelming.

Solution:

Invest in financial management software to streamline processes like expense tracking and budgeting.

Focus on the components of a financial plan, such as maintaining accurate records of income and expenses, to monitor your financial health effectively.

Include regular reviews in your financial planning guide to address areas needing improvement.

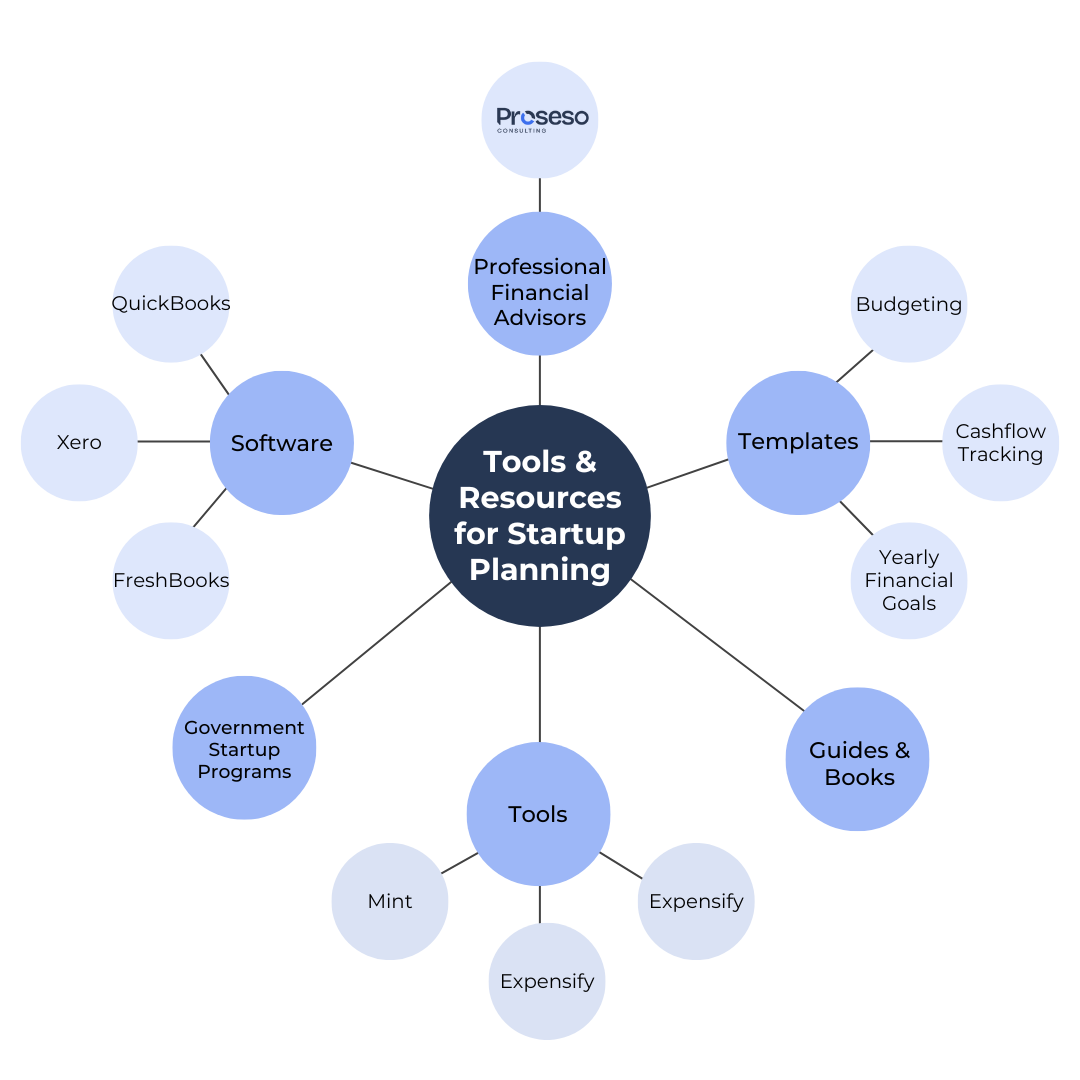

Tools and Resources for Startup Financial Planning

Whether you’re crafting your first financial model or refining your approach, these resources will give you a clear path to success.

Whether you’re crafting your first financial model or refining your approach, these resources will give you a clear path to success.

1. Financial Planning Software

Using financial planning software can simplify the process of managing your startup financial plan. Tools like QuickBooks, Xero, and FreshBooks are excellent for small businesses, helping you track expenses, monitor cash flow, and generate financial statements with ease. These platforms allow you to create and adjust your annual financial plan, ensuring your numbers remain accurate and up to date.

For startups looking to create detailed financial models, software like LivePlan or Causal can assist with building financial projections that align with your business plan and attract investors.

2. Financial Plan Templates

A good financial plan template can save you hours of work. Templates provide a framework for creating a comprehensive startup financial plan, including sections for budgeting, cash flow tracking, and yearly financial goals. Choose a template that matches your business model, ensuring it reflects the unique needs of your startup business.

Startups can find free or paid templates online, often as part of broader guides to financial planning. These templates are a great starting point to create a financial plan tailored to your business’s specific objectives.

3. Budgeting and Cash Flow Management Tools

Managing cash flow is a critical component of any good financial plan. Tools like Mint, Expensify, and Wave help you monitor spending and keep your budget in check. These resources make it easier to include effective financial management strategies in your startup financial plan, ensuring you’re prepared for fluctuations in income and expenses.

4. Financial Planning Guides and Books

Sometimes, the best way to understand the types of financial strategies that work for startups is to read about them. Comprehensive guides to financial planning, such as “Financial Intelligence for Entrepreneurs” by Karen Berman, provide valuable insights into building good financial habits and creating robust financial models.

5. Professional Financial Advisors

6. Government and Startup Support Resources

Why Partner with Financial Experts

Financial experts bring the experience and tools to make this process seamless and effective, ensuring your financial planning for a startup covers all the critical components. Here are the benefits of partnering with financial experts:

Expertise in Crafting a Financial Model for Startups: Financial experts understand the nuances of building a solid financial model tailored to your industry and stage of growth. Whether it’s creating accurate financial projections, developing a budgeting template, or managing your annual financial statements, they know what investors and stakeholders expect to see.

Time-Saving Solutions: Let’s face it: developing a startup financial plan from scratch can take weeks—time you could spend growing your business. Financial professionals streamline the process, helping you create a financial plan efficiently while you focus on your core business activities.

Proactive Financial Management: Financial experts can identify risks and opportunities you might overlook. From cash flow management to setting measurable financial goals, they help ensure your financial plan is part of a long-term strategy that adapts as your startup evolves.

Access to Financial Planning Tools and Insights: Most startups need more than spreadsheets. Financial experts leverage advanced tools and software to create accurate forecasts, track performance, and refine your plan based on real-time data. This is particularly valuable for preparing investor-ready documents, like a business plan or financial statements.

Customized Financial Planning Tips and Guidance: Every startup is unique. Financial experts provide personalized financial planning tips to match your startup business goals and operational needs. They’ll help you design an effective financial strategy that grows with your company.

When is Partnering with Financial Experts Critical?

You’re preparing your first financial plan for your startup and want to avoid mistakes.

You’re seeking funding and need polished financial documents for investors.

Your cash flow management is becoming complex as your business scales.

You want to build a good financial plan but lack the expertise or tools to do it in-house.